Market Overview

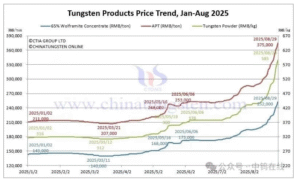

In September 2025, China’s tungsten market continued its sharp upward trajectory, with prices reaching unprecedented levels. Tungsten concentrate prices have exceeded RMB 270,000 per ton, ammonium paratungstate (APT) prices have climbed to RMB 400,000 per ton, while tungsten powder and tungsten carbide powder have surpassed RMB 600,000 per ton.

Key Drivers

The surge is still primarily driven by tight supply. Unexpectedly high tungsten concentrate tender prices at the end of August intensified holders’ reluctance to sell and reinforced bullish market sentiment. However, the traditional peak consumption season has not yet materialized. End users remain cautious, as drastic cost fluctuations have suppressed large-scale procurement.

Market Sentiment

Overall trading activity remains limited despite record-high prices. Market participants are closely monitoring:

Pricing guidance from industry organizations and major tungsten producers at the beginning of September.

Shifts in international market sentiment;

Supply-demand adjustments before and after the September 3 military parade.

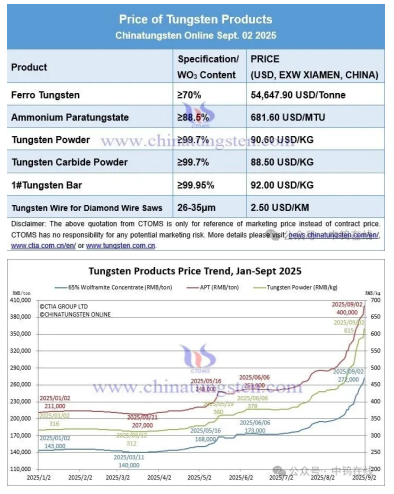

Price Snapshot (as of early September 2025)

65% Wolframite Concentrate: RMB 272,000/ton, +90.2% YTD

65% Scheelite Concentrate: RMB 271,000/ton, +90.9% YTD

Ammonium Paratungstate (APT): RMB 400,000/ton, +89.6% YTD

Tungsten Powder: RMB 615/kg, +94.6% YTD

Tungsten Carbide Powder: RMB 600/kg, +92.9% YTD

70% Ferrotungsten: RMB 390,000/ton, +81.4% YTD

Tungsten Scrap Bar: RMB 430/kg, +95.5% YTD