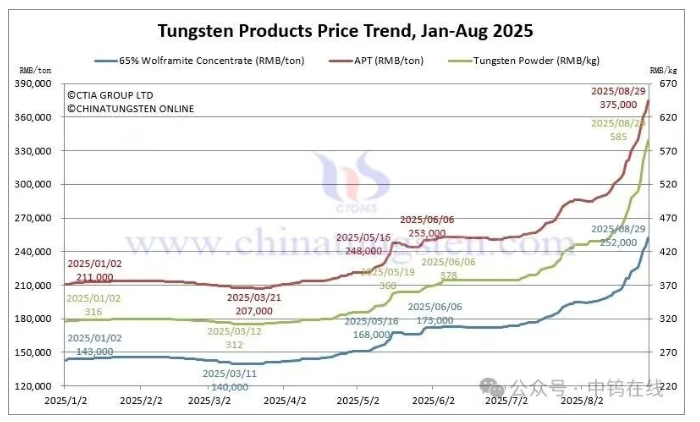

In August 2025, China’s tungsten market continued its strong upward momentum. Major tungsten raw material prices rose by around 30% this month, bringing the year-to-date cumulative increase close to 80%. The monthly average price increased by more than 15% month-on-month and over 55% year-on-year.

Key Drivers of the Price Increase

The price surge in August was mainly driven by the following factors:

Supply bottlenecks and the reluctance of holders to release materials.

The second batch of China’s 2025 total tungsten mining quotas has not yet been announced, while the reduction in the first batch has further reinforced expectations of a tight market.

Environmental and safety inspections have restricted output from mines and smelters.

Inventory depletion following two years of rallies, combined with holders’ reluctance to sell, has tightened spot supply.

Safety production requirements and the nationwide atmosphere ahead of the September 3rd military parade also pushed market sentiment higher in the short term.

Downstream Impact and Enterprise Response

At persistently high price levels, terminal consumption has been significantly suppressed. Apart from rigid demand and certain high-value-added applications with lower price sensitivity, overall market transactions remain limited.

Since the beginning of this year, cemented carbide manufacturers have been forced to announce 3 to 5 rounds of price increases due to raw material cost pressures. Some companies have even stopped publishing unified prices and instead adopted a “one-on-one negotiation” pricing model.

Market Outlook

Overall, the tungsten market closed August with strong performance. In the short term, industry players are closely watching the September 3rd announcements and developments in domestic and international conditions, while remaining cautious about speculative risks.

In the long run, tungsten market demand remains solid, supported by:

National policies promoting domestic demand and consumption;

Continued momentum in high-end manufacturing and strategic projects;

Tungsten’s non-renewable and strategic resource nature, which underpins a long-term upward trend in prices.

Average Price of Tungsten Products in August 2025

Below are the average prices and growth rates of major tungsten products in August 2025:

- 65% Wolframite Concentrate

Average Price: RMB 211,381/ton

MoM: +16.60%

YoY: +55.48%

Monthly Change: End-of-month quotation up 29.23% from the beginning of the month

- 65% Scheelite Concentrate

Average Price: RMB 210,381/ton

MoM: +16.69%

YoY: +55.89%

Monthly Change: End-of-month quotation up 29.38% from the beginning of the month

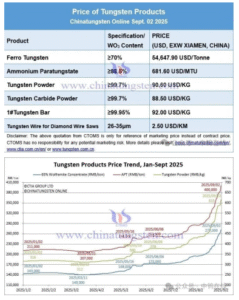

- Ammonium Paratungstate (APT)

Average Price: RMB 312,524/ton

MoM: +18.03%

YoY: +54.68%

Monthly Change: End-of-month quotation up 31.12% from the beginning of the month

- Tungsten Powder

Average Price: RMB 473.10/kg

MoM: +19.43%

YoY: +55.70%

Monthly Change: End-of-month quotation up 36.05% from the beginning of the month

- Tungsten Carbide Powder

Average Price: RMB 461.43/kg

MoM: +19.23%

YoY: +54.40%

Monthly Change: End-of-month quotation up 35.71% from the beginning of the month

- 70% Ferrotungsten

Average Price: RMB 314,286/ton

MoM: +16.80%

YoY: +51.17%

Monthly Change: End-of-month quotation up 27.59% from the beginning of the month

- Tungsten Bar

Average Price: RMB 508.81/kg

MoM: +13.56%

YoY: +37.52%

Monthly Change: End-of-month quotation up 27.66% from the beginning of the month

- Cobalt Powder

Average Price: RMB 299.76/kg

MoM: +9.26%

YoY: +55.20%

Monthly Change: End-of-month quotation up 5.17% from the beginning of the month